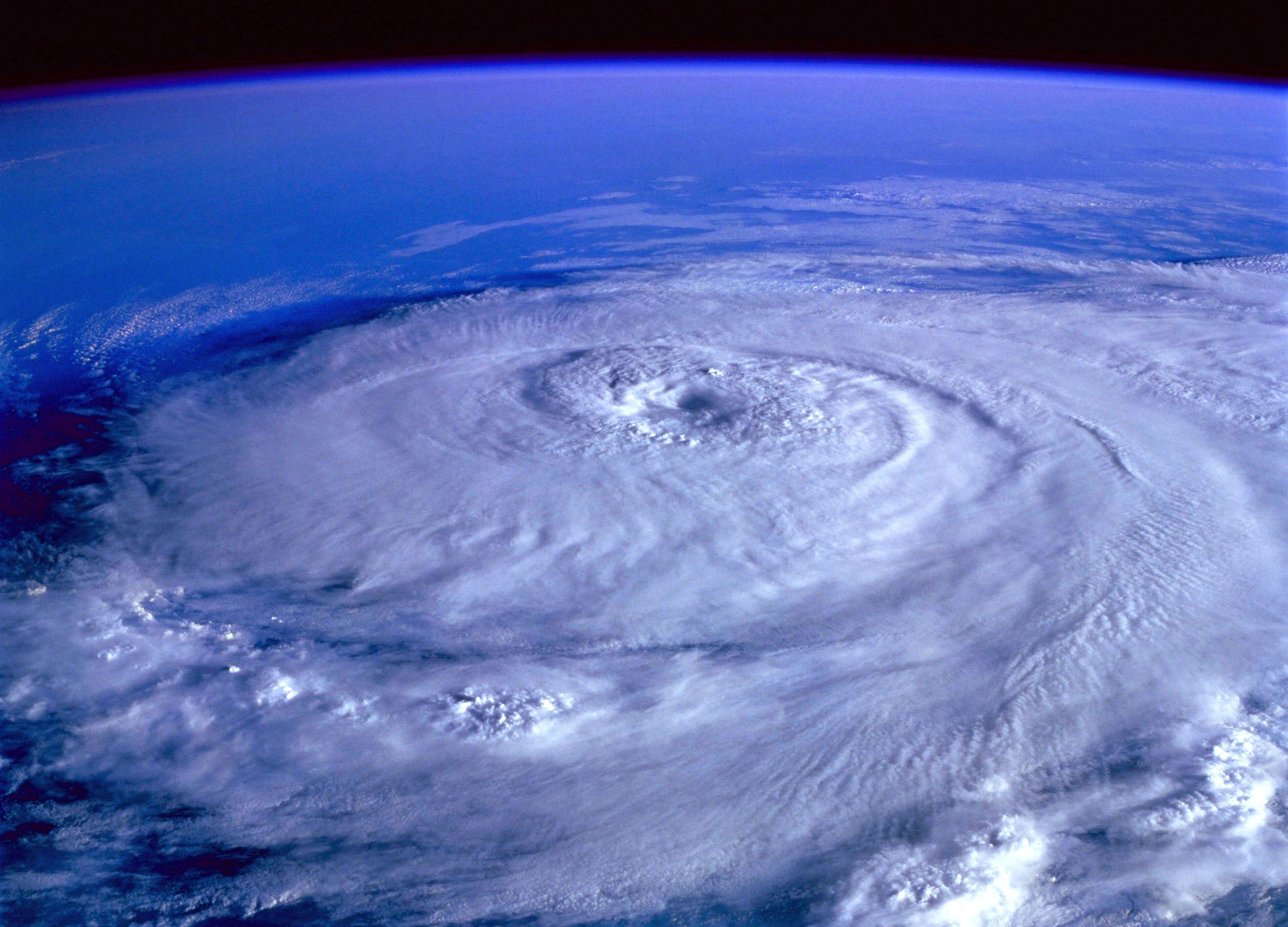

Last month was one of the most active months of any Atlantic hurricane season. Irma and Maria both impacted the Caribbean and US in September, regions already badly hit by the force of Harvey just a week earlier.

Elsewhere in the world, at the time of writing, the latest Atlantic storm, Ophelia, was heading towards Europe, threatening Ireland and the UK, which last saw a tropical cyclone in 1961. Meanwhile Mexico continues to deal with the devastation caused by multiple powerful earthquakes, Asia has witnessed some of its worst floods ever and wildfires rage across California.

As the United Nations marks International Day for Disaster Reduction, Lloyd’s personnel from around the world take a moment to reflect on the events and the efforts to respond to them, as well as considering what this says about climate change and managing future risks.

Responding quickly and effectively to natural catastrophe events has been at the core of what the Lloyd’s market does for centuries, said Jon Hancock, Performance Management Director, Lloyd’s. “In times like these the market steps up a gear to respond as quickly as possible to claims from all over the world. In fact, Lloyd’s has paid close to three quarters of a billion dollars ($738m) in claims so far for Harvey, Irma and Maria. We are living up to our reputation.”

With a network of representatives across the world, Lloyd’s has been able to swing into action quickly, responding to claims and working with policyholders to address and mitigate losses as well as assisting with disposal efforts and repairs. “In one case Lloyd’s advanced tens of millions of dollars to a Florida Keys hotel chain within days of it suffering severe storm damage,” said Phil Godwin, Lloyd’s Head of Claims. “This has enabled them to begin repairs and resume business as quickly as possible.”

In the storm battered southern US, one of the many operational challenges involved in responding to claims has been accessing damaged areas. Lloyd’s agent, Rock O’Keefe, a manager in the cargo claims department at Dufour Laskay & Strouse, Inc., which has offices in Texas and Louisiana, said that his team had received 12 individual assignments from one client in a single day. He also noted that almost all the Lloyd’s agents he’d been in contact with in the affected regions had suffered power outages themselves.

When Irma passed directly across the British Virgin Islands (BVI) as a category 5 storm, Chris Haycraft, a Lloyd’s agent living in Tortola on the BVI, witnessed it first-hand. “The port was a mess,” he said. “Forty foot containers had been thrown around like pieces of plastic, warehouses were destroyed, metal bent in impossible angles, all the buildings gone. Traditional VHF radio became the only mode of communication or you walked to where you needed to be to find someone”.

Elsewhere in the US more than a dozen wildfires are scorching northern California, aided by the state’s epic drought, low humidity and high winds. Richard Magrath, Lloyd’s Regional Director for the Western US, said: “In recent decades, fire seasons in California have grown longer and more destructive, something scientists attribute in part to increased dryness caused by climate change. The US Forest Service declared 2017 the most expensive fire season on record with costs exceeding $2 billion, and that was before the Northern California wildfires broke out.”

In other parts of the world Lloyd’s is supporting the training of international aid workers and first responders in communities hit by recent disasters, through its partnership with international disaster relief charity, RedR. Work is ongoing in response to Irma, as well as the devastating floods in South Asia.

“In a climate changing world, this is exactly what we should expect” said Trevor Maynard, Lloyd’s Head of Innovation. “We should expect to be surprised and we should expect records to be broken. Such events starkly highlight the need for urgent and rapid action as well as strong leadership both politically and in the business world.” To help countries with their response to natural catastrophes, Maynard added, a group of businesses at Lloyd’s have launched a Disaster Risk Facility which pools more than $400m capacity along with expertise to develop reinsurance solutions for natural catastrophe risks in emerging economies.

Originally posted: https://www.lloyds.com/news-and-insight/news-and-features/lloyds-news/2017/10/lloyds-market-responds-to-recent-natural-disasters-around-the-world